If you are an investor seeking regular income and relatively lower risk compared to equities or are seeking alternatives to bank and corporate FDs, then investing in Non-Convertible Debentures is a great choice.

In this blog post, we will discuss the meaning of Non-Convertible Debentures (NCDs), the types of Non-Convertible Debentures, and how you can invest in NCDs in India.

But before we do that, check out the FinnovationZ Broker Comparison tool to find the best broker matching your investment needs and helping you invest in NCDs without hassle.

NCD Debentures Meaning

A debenture is a long-term financial instrument acknowledging the debt borrowed by a company from the debenture holders. It contains a contract that the company borrowing money from the debenture holders will repay the principal after a specified period and pay interest either half-yearly or at fixed dates.

Further, debentures are of two types: convertible and non-convertible debentures.

Convertible Debentures are long-term debt instruments that can be converted into equity shares at the expiry of a specific period.

Whereas non-convertible debentures mean debentures that cannot be converted into company shares and have a fixed maturity period and coupon rate. Since NCDs cannot be converted into stock, these command a higher interest rate than convertible debentures.

Also, an investment in NCDs provides no ownership to the NCD holder in the company issuing such securities, unlike holding company shares that give part ownership to the shareholders. Accordingly, if you invest in NCDs, you only get regular interest payments until the fixed tenure is completed. Once the stipulated period ends, the company issuing the NCD redeems the debenture and pays back the principal amount.

Additionally, companies issuing NCDs give you the option to withdraw the amount at a pre-determined date. This is called the ‘Put Option’. On the other hand, companies issuing NCDs may also reserve the right to redeem the NCDs at a predetermined date. This is called ‘Call Option’.

In India, NCDs are listed with the BSE and NSE. Hence, they are easier to liquidate than National Saving Certificates (NSCs), Fixed Deposits, and other fixed-income instruments with a firm lock-in period.

Further, NCDs are defined under the Securities and Exchange Board of India (Issue and Listing of Non-Convertible Securities) Regulations, 2021 (‘NCS Regulations’).

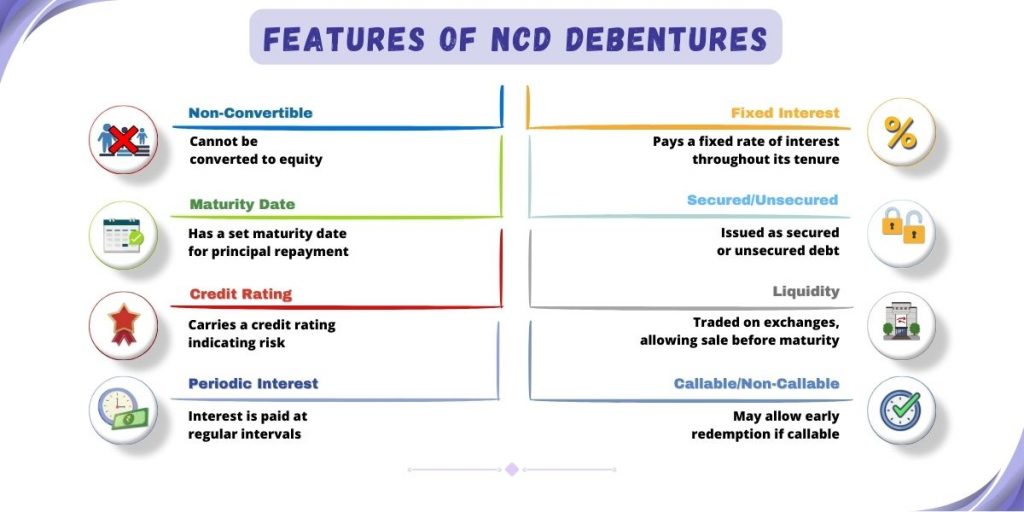

Features Of NCD Debentures

NCDs possess several characteristics that distinguish them as a form of debt instrument in the financial markets. Thus NCDs:

- Cannot be converted into equity shares of the issuing company

- Offer a fixed rate of interest for the entire tenure of the debenture

- Have a predetermined maturity date, at which the issuer is obligated to repay the principal amount to the debenture holders

- Can be either secured or unsecured

- Have a credit rating to indicate the credit risk

- Are traded on stock exchanges if listed, providing you with liquidity and the option to sell debentures before maturity

- Pay interest periodically throughout the tenure of the debenture

- May be callable or non-callable, where callable debentures can be redeemed before maturity while non-callable debentures cannot

Types Of Non-Convertible Debentures

There are two types of non-convertible debentures:

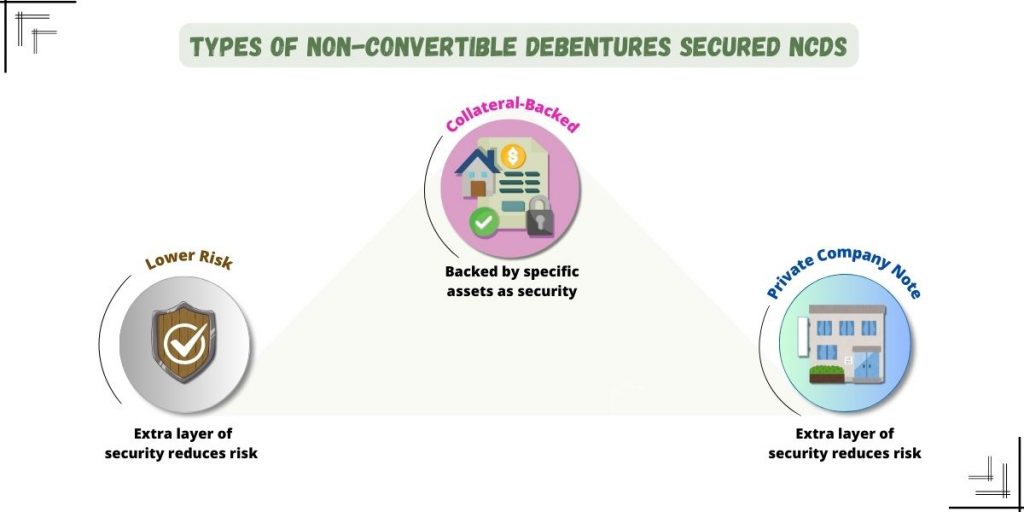

Secured Non-Convertible Debentures

Secured NCDs are a type of NCD that are backed by specific assets or collateral provided by the issuing company to fulfill the obligation to repay the principal on maturity and pay interest periodically. This collateral serves as security for you as a debenture holder, providing you with a claim on the assets if the issuer defaults on its repayment obligations.

Thus, compared to the unsecured NCDs, the secured NCDs are less risky as these offer an additional layer of security in the form of collateral.

It’s important to note that a private company can only issue secured NCDs. If a private company issues unsecured NCDs, those are considered deposits as per the Companies (Acceptance of Public Deposits) Rules.

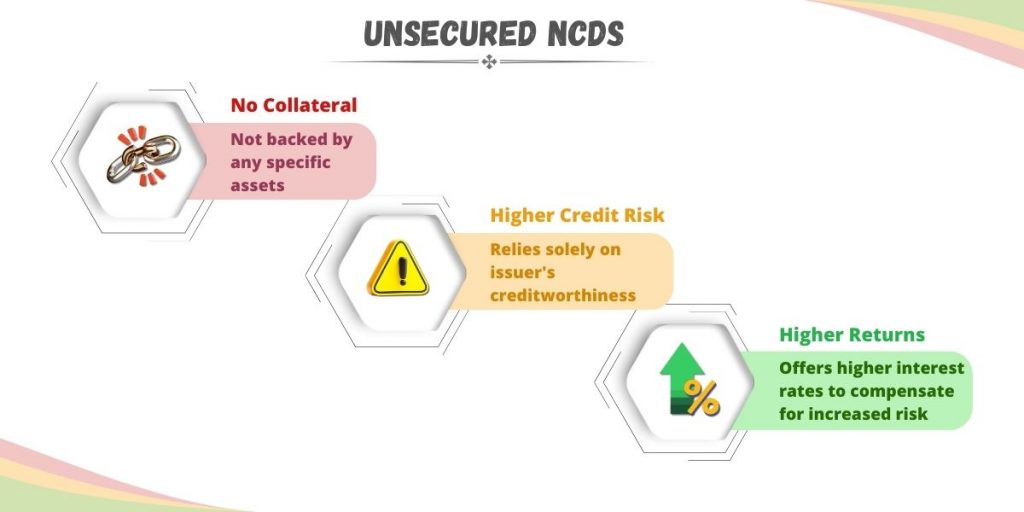

Unsecured Non-Convertible Debentures

Unsecured NCDs are not backed by any specific collateral or assets of the issuing company to repay the principal on maturity and pay interest periodically. Unlike secured NCDs, which are supported by specified assets, unsecured NCDs rely solely on the creditworthiness and financial strength of the issuer for repayment.

Since unsecured NCDs are not backed by any specific assets or collateral pledged by the issuing company, the debenture holders do not have a direct claim on any particular asset to recover their dues in case of default by the issuer.

Thus, compared to secured NCDs, the unsecured NCDs carry a higher credit risk. To compensate you as an investor for undertaking higher credit risk by investing in unsecured debentures, issuers typically offer higher interest rates relative to secured debentures.

How To Buy Non-Convertible Debentures?

You can purchase NCDs through either Public Offerings or Private Placement.

Private placement of NCDs refers to issuing debt securities to a select group of investors in a private transaction, rather than offering them to the general public through a public offering. NCDs through private placement are usually offered to Qualified Institutional Buyers (QIBs) as per Regulation 2(ss) of SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018.

The QIBs can subscribe to NCDs by way of private placement on the Electronic Book Provider Platform (EBP) of the BSE (BSE BOND-EBP) and NSE (NSE-EBP). However, NCD issuer cannot make an offer to securities under private placement to more than 200 persons in a financial year.

Note that you must make payment for NCDs IPO issues via the Application Supported by Blocked Amount (ASBA) Procedure. SEBI made it mandatory to use only the ASBA facility for all issues opening from 01 January 2016 onwards.

ASBA is a process for subscribing to IPOs wherein no funds are transferred from the investor’s bank account to the issuer’s account at the time of application. Instead, the funds in the investor’s bank account are blocked and are transferred only upon successful allotment of subscribed securities. Until then, the investor continues to earn interest on the blocked amount at the contractual rate.

To further streamline the payment process during IPO application, SEBI in 2018 initiated UPI as a payment mechanism with ASBA. Through UPI, retail investors can apply for public issues through intermediaries within 3 working days as against 6 working days through ASBA without UPI.

You can even invest in the NCDs listed on the BSE and NSE through your broker. The way you trade or invest in equity stocks, to trade or invest in NCDs, you need to open a demat account and a trading account with a registered broker and place orders.

Are Non-Convertible Debentures Tax-Free?

No. The interest income you receive on NCDs and other debt instruments held as investments will be charged to tax under the head “Income from Other Sources”. The interest will be taxed at the rates applicable to the investor after deducting expenses allowed under section 57 of the IT Act.

In case you sell debentures before maturity, the interest accrued till the date of sale and included in the sale price may also be charged to tax as “business income”.

Conclusion

NCDs typically offer a fixed interest rate, providing you as an investor with a predictable stream of income over the tenure of the debenture. It can diversify your portfolio and help you spread risk across different asset classes. While NCDs are generally considered less risky relative to equities, they still carry certain risks, such as credit risk, interest rate risk, and liquidity risk. Therefore, you should carefully evaluate the issuer’s creditworthiness before investing in NCDs.