Companies issuing non-convertible redeemable debentures are obligated by the Companies Act, 2013 to create a Debenture Redemption Reserve (DRR). Companies must set aside a certain percentage of the issued outstanding debentures as DRR with such an amount being credited to DRR from the company profits available for dividend distribution. The purpose of the DRR provision is to protect debenture holders from the non-payment of principal and interest in the event of the issuing company liquidating or going bankrupt. In this article, you will learn the meaning of debenture redemption reserve, the percentage of DRR to be maintained by companies, and how DRR is shown in the company financial statements.

What Is Debenture Redemption Reserve?

Debenture Redemption Reserve (DRR) is a fund that companies issuing redeemable non-convertible debentures are obligated to create by section 71(4) of the Companies Act, 2013. Companies must create DRR to the extent of a certain percentage of the total outstanding debentures issued by the company. Further, such a provision must be made out of the issuing company’s profits available for the payment of dividends, and the DRR provision so created can be utilized only for redeeming debentures to the debenture holders. Finally, companies issuing partly converted debentures and obligated to create a DRR will create such a provision only for the non-convertible portion of the debentures as per the rules mentioned below.

The Ministry of Corporate Affairs (MCA) via the notification issued on August 16, 2019, reduced the percentage requirement for DRR for various company types.

Want to learn what debentures are and why you should invest in these debt instruments?

Read our article “All About Debentures – From Meaning to Investing”

What Is Debenture Redemption Investment (DRI)?

In addition to creating DRR, certain companies issuing debentures must also invest or deposit a certain percentage of the value of debentures maturing during the year ending March 31 of the next year in certain investments or deposits. Also, such investments or deposits must be made on or before April 30 each year.

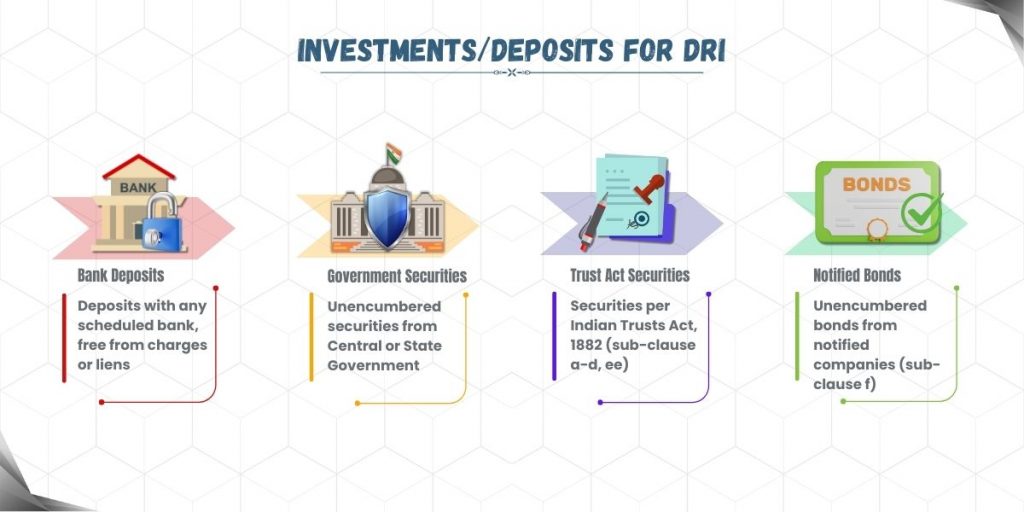

Type of Investments or Deposits For DRI

The companies issuing debentures obligated to invest or deposit for DRI can make investments or deposits in the following:

- Deposits with any scheduled bank, free from any charge or lien

- Unencumbered securities of the Central Government or any State Government

- Unencumbered securities mentioned in sub-clause (a) to (d) and (ee) of section 20 of the Indian Trusts Act, 1882

- Unencumbered bonds issued by any other company that is notified under sub-clause (f) of section 20 of the Indian Trusts Act, 1882

Further, the debenture-issuing companies required to make such investments or deposits can use such investments only for debenture redemption.

Let’s now look at the percentage of DRR and Debenture Redemption Investment (DRI) or Deposit that various companies must maintain.

What Is the Percentage of DRR And DRI?

Before the August 16, 2019, MCA notification, 25% of the value of debentures issued was required to be maintained by various companies as per the MCA notification issued on February 11, 2013. However, the DRR provision was reduced by the MCA for certain companies via its August 2019 notification. The following table gives the DRR provision percentage change as per the August 2019 MCA notification.

Percentage of DRR To Be Maintained By Companies

| S.No | Type of Company | Type of Debentures | DRR as a % of the value of the outstanding debentures issued (as per the MCA August 16, 2019 Notification |

| 1. | All India Financial Institutions(AIFIs) regulated by the RBI | Public and privately placed debentures | Nil |

| 2. | Banking Companies | Public and privately placed debentures | Nil |

| 3. | Listed Non-Banking Financial Companies (NBFCs) registered with RBI under section 45-IA of the RBI Act, 1934 | Public issue | Nil |

| 4. | Listed NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 | Privately placed | Nil |

| 5. | Unlisted NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 | Privately placed | Nil |

| 6. | Listed Housing Finance Companies (HFCs) registered with the National Housing Bank (NHB) | Public issue | Nil |

| 7. | Listed HFCs registered with NHB | Privately placed | Nil |

| 8. | Unlisted HFCs registered with NHB | Privately placed | Nil |

| 9. | Listed Other Financial Institutions (FIs) within the meaning of clause (72) of section 2 of the Companies Act, 2013 | Publicly issued | Nil for listed companies |

| 10. | Unlisted Other FIs within the meaning of clause (72) of section 2 of the Companies Act, 2013 | Privately placed | Nil for listed companies |

| 11. | Other Listed Companies | Public Issue | Nil |

| 12. | Other Unlisted Companies | 10% |

Percentage of DRI To Be Maintained By Companies

The August 2019 MCA notification also outlines the companies obligated to invest or deposit a certain percentage of the value of issued outstanding debentures in certain investments or deposits. These are as follows:

| S.No. | Type of Company | Type of Debentures | DRI as a % of the value of the outstanding debentures issued (as per the MCA August 16, 2019 Notification |

| 1. | Listed Non-Banking Financial Companies (NBFCs) registered with RBI under section 45-IA of the RBI Act, 1934 | Public issue | 15% |

| 2. | Listed NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 | Privately Placed | 15% |

| 3. | Listed Housing Finance Companies (HFCs) registered with the National Housing Bank (NHB) | Public issue | 15% |

| 4. | Listed HFCs registered with NHB | Privately Placed | 15% |

| 5. | Other Listed Companies | Public issue | 15% |

| 6. | Other Unlisted Companies | 15% |

Where is The Debenture Redemption Reserve Shown?

As per Schedule III of the Companies Act, 2013, DRR is shown differently for different companies.

| S.No | Company Types | Where Is DRR Shown? |

| 1. | Companies whose financial statements must comply with the Companies Rules (Accounting Standards), 2006 | DRR is part of the sub-section ‘Reserves and Surplus’ under the ‘Shareholder’s Fund’ in ‘Equity and Liabilities’. One can see the DRR in the notes to the financial statements under ‘Reserves and Surplus’. |

| 2. | Companies who must comply with Ind AS | DRR is included in ‘Other Reserves’ as a separate classification. One can look for DRR in the notes to the financial statements under ‘Other Reserves’. |

| 3. | Non-Banking Financial Companies (NBFCs) that are required to comply with the Ind AS | DRR is included as part of the ‘Other Equity’ under the ‘Equity’ section of the balance sheet. It is shown as a note to the financial statements under ‘Other Reserves’. |

Conclusion

Debenture Redemption Reserve is a fund that certain companies are compulsorily required to make as per the Companies Act, 2013. Such a reserve is made out of the profits available for dividend distribution and can only be used for debenture redemption. Accordingly, DRR serves as protection to the investors in case the debenture issuing company liquidates or goes bankrupt. This is because the debenture issuing company would use the DRR fund to pay outstanding principal and interest payments to the debenture holders.