If you are a retail investor with less risk appetite and seek stable returns, investing in large-cap stocks is your best bet. Large-cap companies include mature and established entities with diversified businesses generating stable revenues and profits. These entities are relatively less prone to market fluctuations owing to their large market capitalization, diversified revenue sources, and stable growth. In this blog post, we’ll help you understand what large-cap stocks are, the benefits of investing in large-caps, and who should invest in these stocks.

What Are Large-Cap Stocks?

SEBI defines large-cap stocks as the shares issued by the 1st-100th company in terms of full market capitalization. Market capitalization is the total market value of a company. This is calculated by multiplying the current market price of the company’s share price by the number of shares outstanding. Full market capitalization means the total market value of a company including the capital raised on all stock exchanges. If the stock of a company is listed on only one recognized stock exchange, full market capitalization on that exchange is taken. However, if a company’s stock is listed on more than one exchange, the average of the full market capitalization of the company stock on all the exchanges is considered to compute a company’s market cap.

Want to learn how the Indian stock market functions?

Register for our Foundation Course On the Indian Stock Market Today!

Large-Cap Stocks List

The Association of Mutual Funds in India (AMFI) is required by SEBI to prepare a list of large-cap, mid-cap, and small-cap companies every six months. Accordingly, AMFI rolls out the list of stocks as per their market cap every June and December of a particular year. Such a list of stocks based on their market cap is prepared by using the data provided by the National Stock Exchange (NSE), the Bombay Stock Exchange (BSE), and the Metropolitan Stock Exchange of India (MSEI). Also, the list is uploaded on the AMFI website within 5 days from the end of the 6 months. The latest list of stocks based on market cap is for July – December 2023.

Examples of Large-Cap Stocks In India

Examples of large-cap stocks in India include:

- Reliance Industries Ltd (Ticker Symbol: “RIL”)

- Tata Consultancy Services Ltd (Ticker Symbol: “TCS”)

- HDFC Bank Ltd (Ticker Symbol: “HDFCBANK”)

- Hindustan Uniliver Ltd (Ticker Symbol: “HINDUNLVR”)

- Infosys Ltd (Ticker Symbol: “INFY”)

- ITC Ltd (Ticker Symbol: “ITC”)

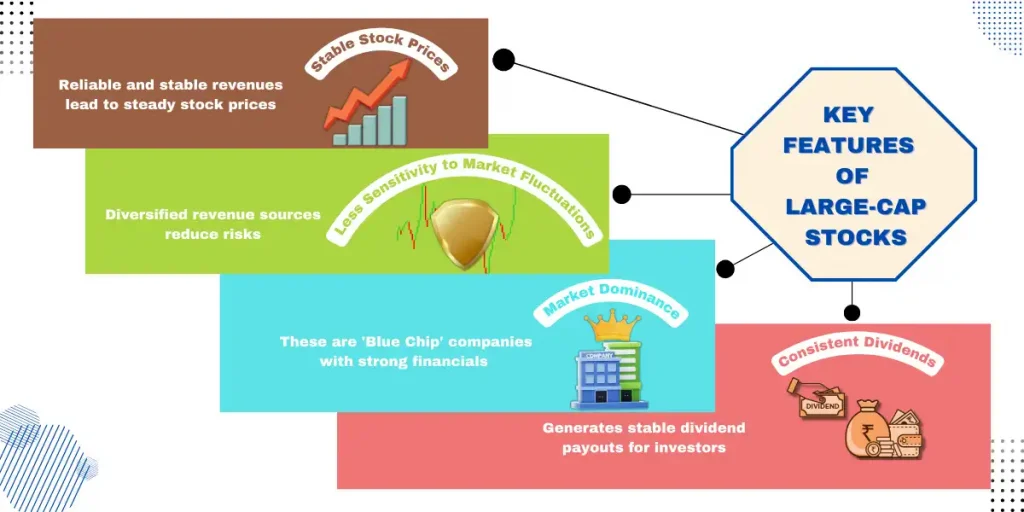

Features of Large-Cap Stocks

1. Stable Stock Prices

Large-cap companies are well-established players in their industry, known for producing high-quality products and services. They have diversified businesses meaning that they have wide-ranging sources of revenue and have a history of high performance. Additionally, these companies have endured economic crises, market cycles, and global uncertainties which small-cap companies are still learning to cope with. As a result, large-cap companies have reliable and stable revenues and profits which lends stability to their stock prices.

2. Less Sensitive To Market Fluctuations

Stocks of large-cap companies are typically called safe-havens. This is not to say that such companies do not get impacted by economic downturns. However, given their diversified revenue sources and presence across the globe, large-cap companies can cope better with the economic crisis. Their large scale of business, huge market share, and wide-ranging revenue sources make them less susceptible to economic and market downturns.

3. Market Dominant Players

These stocks belong to companies that are market leaders in their industry. They are well-established entities that have a proven track record of performance and recognition. These players lay out the industry trends and influence consumer choice. Typically, these are called ‘Blue Chip’ entities because of their authority, strong financials, and reliable and stable earnings.

4. Safe or Low-Risk Investments

Large-cap stocks are considered conservative investments and generate stable returns even during the economic downturn. That is why these are called safety stocks and investors add these stocks to their portfolio to diversify the risk and earn stable returns even during crises.

5. Low Potential For Growth

Although large-cap companies are known for giving stable returns to investors, they have a low growth potential. This is because these are mature companies that have passed the stage of high growth. This is unlike small-cap stocks, which may be more risky and generate volatile returns. However, investors with a high-risk appetite choose to invest in small-cap stocks owing to their explosive growth potential.

6. Consistent Dividend Payments

Another thing characteristic of large-cap companies is their consistent dividend payments. Since large-cap companies have crossed their aggressive growth phase, they compensate the investors by paying consistent dividends. Accordingly, investors looking for dividend-paying stocks must invest in large-cap shares.

Advantages of Investing In Large-Cap Stocks

1. Less Volatile Stocks

Large-cap stocks are less susceptible to economic headwinds given their diversified businesses generating stable returns. These companies are known for producing top-grade goods and services, have a strong brand identity, and a history of stable revenues and profits. Given the diverse revenue streams serving as a cushion against uncertain market situations, the stock prices of these companies are less volatile during economic crises. That’s why these are called safety stocks or safe havens as they help investors in reducing overall risk by adding these stocks to their portfolio.

2. High Liquidity

Large-cap stocks have a large trading volume. This means that a large number of large-cap stocks are bought and sold on the exchanges each day. This allows the investors to enter and exit stocks easily as compared to mid-cap and small-cap stocks, making them preferred investments by both the conservative investors as well as the investors looking for mitigating risk.

3. Stable Dividends

As discussed earlier, if you are an investor looking for stocks that pay consistent dividends, look no further than the blue-chip stocks. Typically, large-cap stocks pay stable dividends to the investors as compensation for the less aggressive growth potential of these companies.

4. Risk Mitigation

Investors add large-cap stocks to their investment portfolios for risk mitigation. Since these stocks generate stable returns even during economic downturns, these help investors diversify and reduce the overall risk of their portfolios. Even if other investments in the portfolio are not generating good returns, large-cap stocks generally provide stable returns, even during uncertain market situations.

Who Should Invest In Large-Cap Stocks?

The following entities can invest in large-cap stocks:

- Conservative investors with low-risk appetite seeking capital preservation

- Investors seeking stable dividend income

- Investors who want to diversify their investment portfolio risk can invest in blue chip stocks. This is because large-cap stocks help in reducing the portfolio risk given their stable returns even during the economic downturn.

Conclusion

Large-cap stocks belong to companies that have a diverse nature of businesses, have a strong brand identity, and have strong financials. These are also called blue chip stocks because of their market dominance, proven track record of performance, and stable growth. Therefore, these stocks are for investors with a low-risk appetite, seeking stable dividend payments, and wanting to preserve their capital. But, if you are a risk-taking investor seeking high growth but volatile stocks, mid-cap and small-cap stocks are the stocks you should be investing in.