Are you a retail investor in India who wishes to invest in stocks of a company listed on foreign stock exchanges? Or are you an NRI or a foreign investor who is seeking to invest in stocks of companies listed on Indian stock exchanges? In case yes, then you can do so by the Global Depository Receipt (GDR) route.

In this blog post, we are going to discuss what Global Depository Receipts (GDRs) are and how you can invest in stocks of foreign companies through GDRs.

But before we do that, check out our Foundation Course On Stock Market to learn basic practical applications in the stock market, how to pick the right stocks, and how to make your stock portfolio.

Background

Before the amendment was made to section 5 of the Companies Amendment Act 2020 on October 30, 2023, the companies incorporated in India intending to raise capital from foreign equity markets were not permitted to directly issue rupee-denominated securities and get them listed on foreign stock exchanges.

Likewise, companies incorporated outside India could not directly list their equity shares on Indian stock exchanges before the abovementioned 2023 amendment.

Accordingly, if a company incorporated in India wanted to raise funds through the equity capital markets of foreign jurisdictions or a company incorporated in a foreign jurisdiction wanted to raise funds through the Indian equity markets, the only available route was through issuing Deposit0ry Receipts.

What Is A Depository Receipt?

A depository receipt (DR) is a type of negotiable certificate representing equity or debt securities issued by a foreign company, trading on a local stock exchange. The DRs are not shares. Rather, they are transferable financial instruments representing equity or debt securities issued by a company incorporated in a foreign jurisdiction.

The company issuing the equity or debt securities underlying DRs deposits the securities at a bank in its country of residence. Such a bank acts as a custodian of the securities. In addition to this, the company issuing the securities appoints an overseas depository bank that issues DRs in its local capital markets and other foreign capital markets. This way DRs allow investors to trade shares of foreign companies in their local capital markets without the need to directly purchase shares on foreign exchanges or deal with foreign currencies.

There are different types of Depository Receipts (DRs) in which you can invest. However, the two most common types of DRs include the Global Depository Receipts (GDRs) and the American Depository Receipts (ADRs).

What Is A Global Depository Receipt?

A Global Depository Receipt (GDR) is a type of DR issued by a depository bank representing shares in a foreign company, traded on exchanges outside of the US and the company’s home country. These can be issued either through public offering or through private placement. Once issued, GDRs can then be listed or traded in an overseas listing or trading platform.

Typically, GDRs are traded on the London Stock Exchange or the European stock exchanges such as the Frankfurt Stock Exchange.

Further, GDRs are denominated in a currency other than the issuer’s domestic currency. This feature of GDRs makes them attractive to international investors who wish to invest in foreign companies without having to deal with the complexities of foreign exchanges or currencies.

The process of issuing GDRs involves :

- A company issuing equity shares denominated in its local currency to a foreign depository.

- Then, the company issuing shares appoints a custodian in his home country who would keep these shares in its custody.

- Next, the foreign depository will issue dollar-denominated receipts, called GDRs, to investors in the local stock exchanges. Additionally, the depository will set the ratio between the GDRs and the equity shares, that is, how many equity shares will be issued against one GDR.

- Once the foreign depository sets the ratio between the GDRs and the equity shares, GDRs will be issued publicly. The investment banks would organize road shows and market the issue to institutional and retail foreign investors.

- Finally, the GDRs will be listed on the foreign stock exchange.

Note that if any company incorporated in India wants to access the global financial markets through the GDR route, they can list their international receipts at the International Financial Services Centre in Gujarat.

As per the revised guidelines, a company can now issue GDRs through a public offering, a private placement, or any other way permitted in the applicable jurisdiction. Furthermore, businesses that intend to issue GDRs must first seek approval from the Foreign Investment Promotion Board and Ministry of Finance (FIPB).

Features Of GDRs

- GDRs are negotiable financial instruments and can be traded freely.

- Only Indian companies having a strong financial backing of about 3 financial years are allowed to enter the global financial markets through the GDR route. Further, such companies are required to obtain clearance from the Foreign Investment Promotion Board (FIPB) and the Ministry Of Finance.

- GDRs are denominated in a currency of foreign jurisdiction where they get listed whereas the equity shares underlying the GDRs are valued in the home currency of the issuer.

- Investors holding GDRs get the benefits and the rights of the underlying equity shares including dividends and voting rights.

What Are The Benefits Of GDRs?

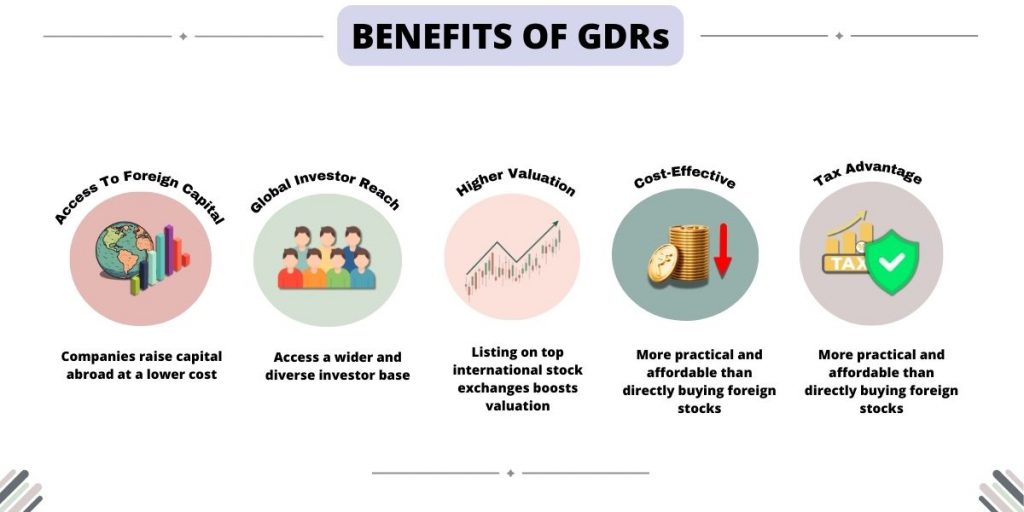

- The equity shares listed by companies incorporated in India on foreign stock exchanges through the GDR route would allow them to access foreign capital at a lower cost.

- Such companies can reach a wider and more diverse audience of potential investors.

- Since the shares of the GDR issuers get listed on well-known international stock exchanges, they are better valued.

- GDRs are more practical and more affordable than directly buying stocks on foreign exchanges.

- GDRs are not subject to capital gains tax when a nonresident transfers the GDRs of a listed firm to another nonresident outside of India.

Global Depository Receipts Example

The table below showcases the GDRs of companies, incorporated in India, and listed on foreign stock exchanges.

| DR Issue | DR Venue |

| Aditya Birla Capital | Luxembourg Stock Exchange Euro MTF |

| Ambuja Cements | Luxembourg Stock Exchange |

| Aptech (Lux Listed) | Luxembourg Stock Exchange |

| Aqua Logistics | Luxembourg Stock Exchange |

| Axis Bank | London Stock Exchange |

| Bharat Forge | Luxembourg Stock Exchange |

| Bharat Hotels | Luxembourg Stock Exchange |

| Bombay Dyeing & Manufacturing | Luxembourg Stock Exchange |

| Cipla | Luxembourg Stock Exchange Euro MTF |

To view the complete list, check BNY Mellon.

What Is The Difference Between GDR And ADR?

GDRs and ADRs are both types of depository receipts used to facilitate investment in foreign companies. However, there are several key differences between the two.

| S. No. | Features | GDRs | ADRs |

| 1. | Location of Issuance | Issued and traded outside of the US, typically in major financial centers such as London, Luxembourg, or Singapore. | Issued and traded in the US. |

| 2. | Regulatory Framework | Are subject to the regulations of the country where they are issued and traded. | Are subject to the regulations of the U.S. Securities and Exchange Commission (SEC). |

| 3. | Currency Denomination | Are denominated in a currency other than the issuer’s domestic currency. | Are denominated in U.S. dollars. |

| 4. | Investor Base | Attract investors from outside the United States who seek exposure to foreign stocks. | Primarily cater to U.S. investors who wish to invest in foreign companies listed on U.S. exchanges. |

Conclusion

Overall, GDRs offer companies an effective mechanism to access international capital markets, diversify their investor base, enhance their visibility, and improve liquidity, while also providing strategic and financial flexibility for pursuing growth opportunities on a global scale.