UPI has become a quirky friend whom we meet daily. May it be at a food stall, a grocery shop, or a luxurious jewellery showroom.

UPI has become a need of the hour in today’s world.

Before we get into the process and steps to connect a Credit card to UPI, we need to understand what UPI is.

UPI is a real-time payment system that allows users to transfer money between two bank accounts via mobile application.

Users can transfer money either directly from bank account, or debit cards, credit cards. The most commonly used UPI apps include Google Pay, Phonepe, Paytm, Amazon Pay, etc.

Before diving into the ocean of benefits of usage of UPI, let’s learn how to link a Credit Card with your UPI and make payment using the UPI credit card feature.

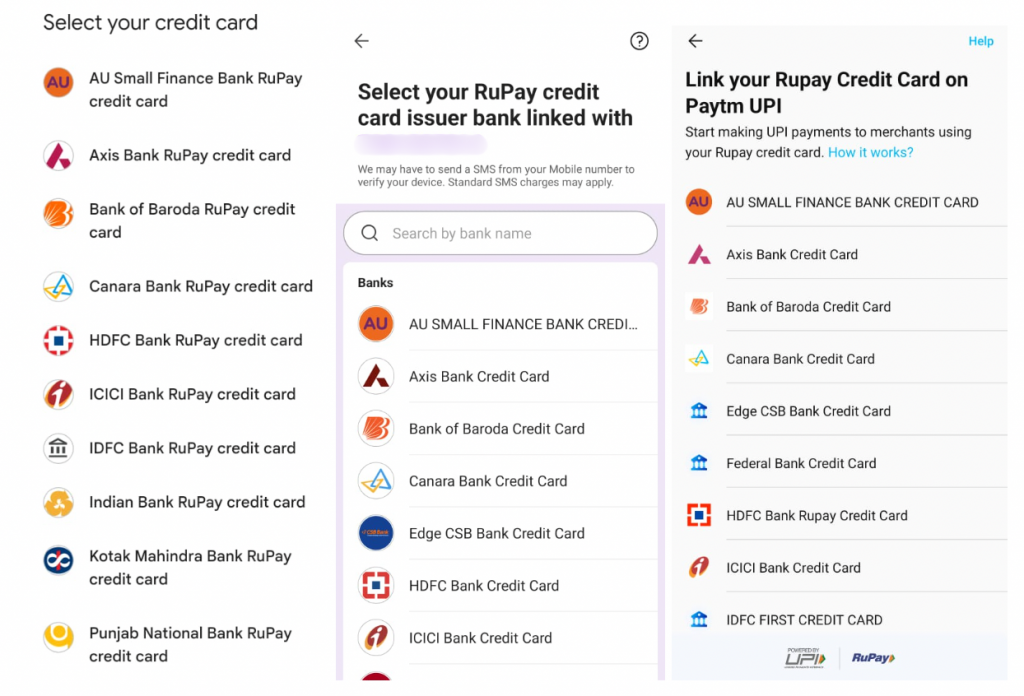

National Payments Corporation of India recently collaborated with Google Pay and allowed the integration of RuPay Credit Cards with UPI. After this RuPay announced that the UPI credit card feature will be accessible by all its card users of different banks including, Axis Bank, Canara Bank, Punjab National Bank, HDFC, Kotak Mahindra Bank, Indian Bank, Bank of Baroda, Union Bank of India. More banks will soon join the list as per the announcement.

Steps to link Credit Card to UPI

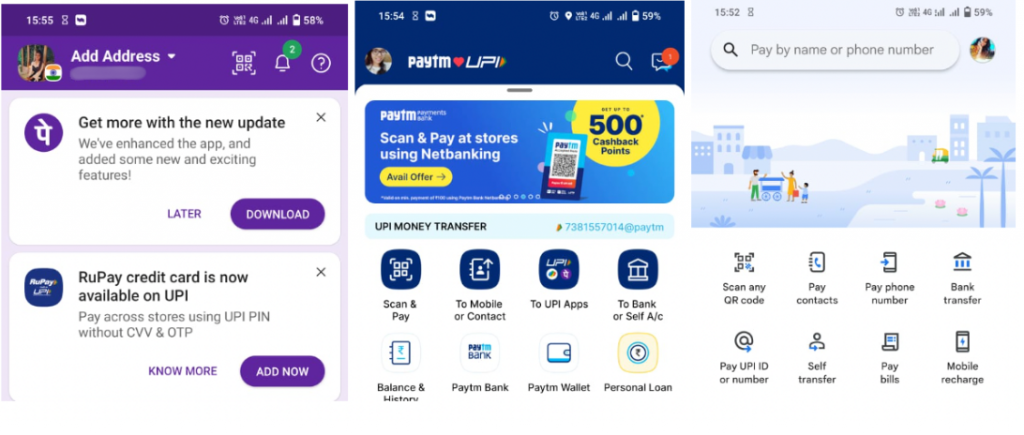

Step 1 – Install any UPI Payment Mobile Application like Gpay, Phonepe, Paytm, etc.

Step 2 – Create an account with the application, if you don’t have one already

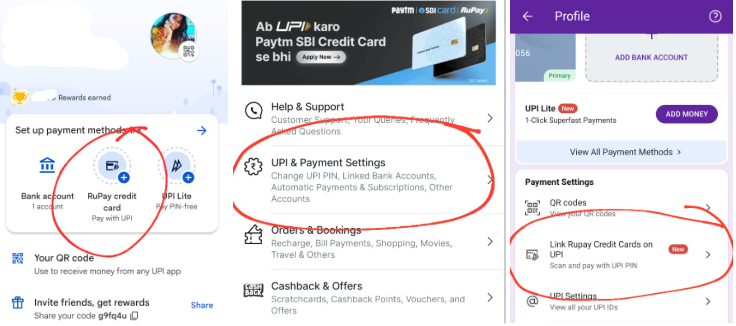

Step 3 – Click on the profile icon

Step 4 – Select,

- RuPay credit card on the Set up payment method

- UPI and Payment Settings on Paytm, and

- Link RuPay credit card on UPI on PhonePe

Step 5 – Add your credit card linked with your phone number /by clicking on Add new card on all the applications.

Step 6 – Fill in all the details of the credit card which you want to link to the app

Step 7 – Perform OTP authentication

Step 8 – This step works differently on different applications,

- The card will be activated on the Gpay account.

- Paytm will auto-debit Rs. 2/- from your credit card for verification, which will be credited back in minutes.

- The UPI credit card will be activated after the OTP verification on the Phonepe account.

Important restrictions on UPI credit card payments.

- The transaction limit for UPI Credit Card facility is Rs. 1 Lakh per card per day or credit limit, whichever is lower.

- Only merchant payments are allowed to use the facility and not to send funds to another consumer at present.

- As per a recent amendment, only RuPay Credit Card is allowed for UPI linkage, while most banks issue credit cards on the Mastercard Kr Visa network.

Benefits of using UPI transactions

This feature has brought a revolution in the financial market of India. UPI provides a seamless experience to users and eases the process.

Recent data from the Reserve Bank of India suggests that there is exponential growth of UPI payment which records daily transactions of crossing 36 crore, which earlier was 24 crore in February 2022. UPI credit card will surely bring a new revolution to this record.

List of benefits of UPI Credit Card facility,

- Instant payments and receivables – UPI transactions make instant money transfers enabling users to ensure quick payment and receivables.

- Secured and encrypted transactions – UPI transactions are secured via two-factor authentication with a PIN or biometric authentication. This reduces the risk of unauthorized transactions.

- Cost-Effective – UPI transactions often have minimal or no transaction fees, saving a lot of money.

- UPI payments via credit card and timely repayment can help the user improve their credit score.

- Multiple bank account unification – UPI apps often allow users to link and manage multiple bank accounts which provides flexibility in managing finances.

- Convenience – UPI supports the cause of “Digital India” by allowing its users to make digital payments with their smartphones 24/7, which also eliminates the need for physical cash or ATM withdrawals, or instant credit repayment.

- Innovative Features – UPI apps continuously introduce new features, such as investing in mutual funds, purchasing insurance, and, regular rewards and cashback benefits.

- Bill payments including DTG recharge, Mobile recharge, electricity bills, insurance premium, etc. can be made in seconds without waiting in long queues.

- The government supports UPI and promotes the initiatives with the introduction of applications like BHIM.

- Payments can be made to any place in India at any hour of the day saving a lot of transportation and time.

- Trackable Transactions – Users can easily track their transaction history to manage their finances.

As Thomas Jefferson says, “A coin has two sides“, Everything that comes with an abundance of advantages will always have certain disadvantages. Some of these are,

- UPI allows smallest to smallest fund transfers, making it difficult to manage finances and spending more than required.

- Chances of Online Fraud -Such cases have increased with the increase in transactions.

- A four or six-digit UPI PIN might not be sufficient to protect your account.

- Slow bank servers or internet issues can hold the amount for hours or days in case of failure of payments.

Now that we have learned about the numerous benefits and certain drawbacks of UPI payments, the primary point of discussion that arises is, Whether is it a good idea to connect UPI to Credit Cards.

The UPI credit card feature is a game changer in the financial market. However sensible usage of such facility will still be recommended.

When a person uses a credit card to make payment, it’s a short-term credit or to say a type of loan, which he/she will need to repay soon. Now understand that the UPI credit card facility will make the payment a lot more smoother and convenient, making you spend more. Credit card spending can increase the debt making you forget how much you are willing to spend. Such financial indiscipline can lead to financial hardship in the future.

To avoid such situations, using a UPI credit card for emergencies is preferably recommended and regular payment can still be made via a UPI bank account or debit card.

Conversely, if you have great financial control and you understand the stress of financial burdens, you probably won’t spend recklessly and this way UPI credit card feature is a great idea for you. As one can make payment via credit card-linked UPI in a single tap, the pay function is perfect for its users.

The impact of Credit Card linkage to UPI on Credit Card Industry

UPI credit card feature is undoubtedly a visionary step towards the financial growth of India, but what will be the impact of this feature on the credit card industry? While you might be surprised to know, this feature can help in the potential growth of the credit card industry in India.

The credit card industry is a part that works with fewer users and believe it or not, many people in India still think of credit cards as a burden. People do not opt for credit cards as it will create financial stress of repayment of amount to them and the risk of overspending waives off the whole idea.

Apart from what a smaller section of society thinks to improve their chances of loan approvals and other benefits via good credit scores, a common middleman would never opt for one.

- UPI credit card facility will bring a drastic change in this style of working as with the introduction of credit card payments via UPI, the industry expects an increase in the issuance of credit cards in the country. Data suggests that the Credit Card Industry can expect a significant growth of 18% with the introduction of the UPI credit card feature.

- UPI facility will allow merchants to accept payment through credit card without a Point of Sale terminal, making the whole process seamless.

- Most UPI payments are small ticket payments, 50% of them being less than Rs. 200/-. The ticket size can increase considerably as people tend to use credit cards to make larger payments than their debit cards.

However, a crucial question that arises is, what will impact MDR?

MDR – Merchant discount rate is a major way to earn money via credit cards as MDR is the rate at which merchants are charged for accepting Credit Card payments and funds paid via net banking and Digital Wallets. MDR fees were waived for debit cards in 2020. There is a 2-3% MDR charge for every transaction value for credit card usage and it becomes a decided factor for the impact on the industry.

UPI gained a revolutionary success in the market one of its reasons as zero MDR fees. MDR fees do not apply to the UPI credit card facility as of now. However, no clarity has been made if it would be charged or not. At present MDR charges are applicable on RuPay credit cards but not on UPI transactions via these cards.

Experts say, that since the facility is only available to RuPay cards to date, this can be a good way to test the results of the UPI credit card feature and to have a controlled market.

To bring an end to this discussion, UPI has gained a remarkable position in the financial industry and the launch of the UPI credit card feature will only enhance its overall worth. While the decision to use this facility solely depends on the user, the path to reach the decision can be made by stepping into the steps, advantages, disadvantages, and impact, of UPI credit card as discussed in the blog.

Frequently Asked Questions

- How can I link my credit card to UPI?

Answer- To link your credit card to UPI, open the UPI app and go to the linked bank section. Select “Add New Account” and choose your credit card from the list of supported banks. Follow the instructions given above to complete the linking process. - Is it safe to link my credit card to UPI?

Answer – Yes, it is safe to link your credit card to UPI. UPI uses security measures like two-factor authentication and encrypted transactions to safeguard your financial information. - Can I link multiple credit cards to UPI?

Answer – Of course, you can link multiple credit cards to UPI. Most UPI apps allow you to add multiple bank accounts, including credit cards. Simply follow the same process mentioned earlier for each credit card you want to link. - How can I unlink my credit card from UPI?

Answer – To unlink your credit card from UPI, open the UPI app and go to the linked bank section. Select the credit card you want to remove and click on the “Unlink Account” or similar option. Confirm your choice and the credit card will be unlinked from UPI. - Can I use my linked credit card for UPI transactions?

Answer- With the new addition to RuPay credit cards, Yes. Once your credit card is linked to UPI, you can use it for UPI transactions. Just select the credit card as the payment mode during a transaction, and the funds will be debited from your credit card. Ensure you have a sufficient credit limit for the transaction.