Introduction

Being an investor, the most important factor while investing is returns. Investing in a company’s stocks means the investors believe that the investment to be profitable and successful in the future. And if the company performs well, the benefit of the company will directly link to investors’ benefit. This profit in capital invested in a company when measured is called the return on capital employed, commonly known as ROCE.

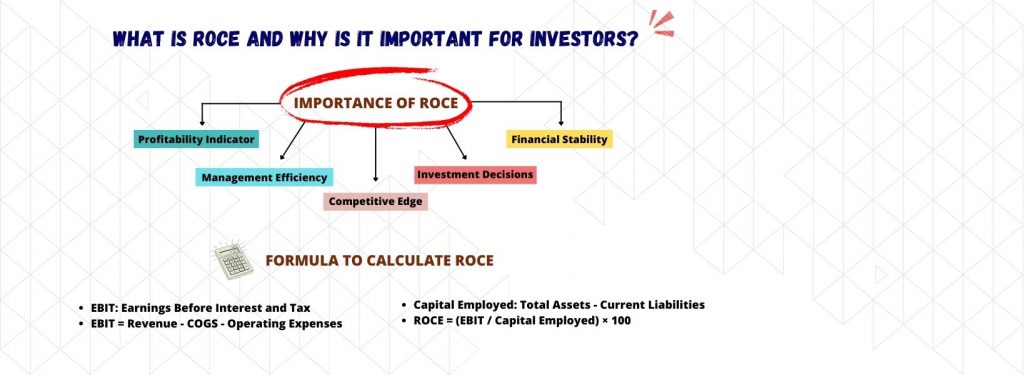

In other words, ROCE is a long-term profitability ratio that measures how effectively the company is using its capital and the expected profit that could be generated from each penny employed. Investors as well as companies consider ROCE as one of the best metrics to measure expected profits. Investors use this metric to determine whether or not to invest in the company.

The higher the ROCE, the stronger the profitability. Investors compare the ROCE of different companies in the same industry to make investment decisions. ROCE is also important from the company’s point of view, as it indicates the company’s performance over the years.

How to calculate ROCE?

Well the formula to calculate ROCE is quite simple,

ROCE = (EBIT/Capital Employed) * 100

Here,

EBIT is Earning before interest and tax, which is the company’s profit including all expenses minus interest and tax expense.

EBIT= Revenue - COGS (Cost of Goods sold) - Operating expenses

And,

Capital Employed is the total amount of equity invested in the company.

Capital Employed = Total Assets - Current Liabilities

Or,

Capital Employed = Equity + Non-current Liabilities

Or,

Capital Employed = Fixed Assets + Working Capital

Illustration

Let’s take two companies, for instance, Company A and Company B

Company A has the following financial information,

EBIT = Rs. 1000000

Total Assets = Rs. 4500000

Current liabilities= 1000000

Now,

Capital Employed by Company A will be

Total Assets – Current Liabilities

4500000-1000000

3500000

ROCE = (EBIT/ Capital Employed) *100

= (1000000/3500000) * 100

= 0.28*100

= 28%

Company B has the following financial information,

EBIT = Rs. 300000

Total Assets = Rs. 2500000

Current liabilities= 1100000

Now,

Capital Employed by Company A will be

Total Assets – Current Liabilities

2500000-1100000

1400000

ROCE = (EBIT/ Capital Employed) *100

= (300000/1400000) * 100

= 0.21*100

= 21%

Now, the ROCE of Company A is more favorable than Company B. Thus, an investor while choosing,g will prefer Company A for investment purposes.

Importance of ROCE for Investors

ROCE helps investors as it is an important indicator to find out whether a company is worth investing in.

- Profitability measure – Return on Capital employed measures how effectively and efficiently the company is performing and can generate profit on its capital.

- Company’s management – ROCE helps the investors to understand the company’s management and its effectiveness.

- Competitive edge – Higher ROCE provides a competitive edge over the potential competitors in the industry.

- Investment decisions – Comparing the ROCE of different companies in the same industry helps the investors to make investment decisions. It helps the investors to find out the company’s worth and its prospects.

- Financial performance – ROCE provides an overview of the company’s financial stability and performance. It also presents an idea of the company’s long-term sustainability in the market and its future growth.

Limitations of ROCE

Every metric that offers benefits, has certain limitations as well. Some of these are,

- Inaccuracy – ROCE does provide accurate results when the comparison made is between companies from different sectors.

- Past financial data – ROCE is based on past financial data and only looks for short-term achievements and performance. It does not accurately reflect the current market changes and growth prospects.

- Manipulation – People can manipulate the returns through accounting techniques or financial engineering. It can bring changes to the financial data and industry as a whole.

- Balance sheets – The assets are valued at book value. Assets tend to depreciate with time and affect the ROCE.

Factors affecting ROCE in the Share Market

There are a few factors that influence the ROCE in the share market,

- Invested Capital – The more capital a company invests, the lower the ROCE. Companies with more fixed assets can have reduced returns.

- Profitability – Factors like cost structure, operational efficiency, & pricing power impact the profitability of the company ultimately affecting the ROCE positively.

- Country’s economy – Overall economic condition also affects the company. Recession or inflation impacts the ROCE.

How companies can improve their ROCE?

With strategic planning and management, companies can improve their ROCE. Better ROCE also helps companies to develop a competitive edge over their competitors.

- Focus on cost management, cost reduction, improving productivity, product pricing, and operational efficiency

- Optimum utilization of capital and reducing infusion of excess capital

- Opt for more feasible options and avoid expensive debts

- Investing in potential return projects and disinvestment in non-performing stocks

- Elimination of waste of resources and overlapping of operations

- Reviewing sales and growth in regular intervals

Bottom line

ROCE is a financial profitability metric that helps the companies as well as the investors to understand the financial performance and growth prospects of the company. Well, it’s not the only metric assessing the company’s financial performance but is one of the most efficient ones.

Investors can easily calculate the return on capital employed using the financial information of the company. There’s a risk involved of inaccuracy of financial statements and comparisons with different sectors.

Having an ROCE ratio of 20% or more depicts that a company is performing well.

FAQs

1. What does ROCE tell traders?

– ROCE helps the traders to grasp an understanding of how well the company is performing financially. Companies can have similar earnings, sales, and profit margins, but the performance can be judged based on returns only.

2. What does it mean for capital to be employed?

– When a business infuses capital to conduct its operations and grow its business with new opportunities and development projects, it means they are employing capital.

3. Which is better ROCE or ROE?

– ROCE is the return on capital employed and ROE is the return on equity. ROE is calculated by dividing Net income by Shareholder’s Equity. Investors suggest ROCE to be a better measure of the company’s performance as ROE focuses on equity.

4. Is higher ROCE good?

– There is no specified standard on a good ROCE value. However, an ROCE of 20% or more is considered better.