The share market is an ocean of knowledge and this knowledge can be grabbed by understanding the terminologies, charts, data, and graphs. While some of them are vast and complex to understand, some terms and concepts are comparatively easier.

Being an investor, a person needs to understand these terminologies of the stock market. One of them is the current market price, popularly known as CMP. And if you are an investor, then this blog is for you.

What is CMP?

CMP in the stock market means the current market price. It is the market price at which the stocks are being traded currently. The trade price at which the investors can buy or sell the particular share at that particular time.

As we all know the price of the share is never constant and keeps on changing. Thus CMP is never constant and is important. The price changes with each trade being taken place in the stock market in seconds. In fact, it is one of the most prominent elements for investors to make their investment decisions.

How to calculate CMP in the share market?

Finding out CMP in a share market is easy. Just head to any trading website and search for the desired company’s name. You will get the current price and volume on top.

This price is supposed to fluctuate significantly during uncertain market conditions and a volatile market. This is the time when people book their profit or incur a loss in their owned shares.

Importance of CMP

Once you understand the meaning of CMP and how to find it, the next step is to get the hang of the role of the current market price. CMP of the stock plays a prominent role in making investment decisions. It tells the price of the stock at a particular time.

CMP also helps the investor to grasp an understanding of how the stock will perform in the future. CMP can be better understood if you know about LTP i.e. last traded price. Let’s have a look.

CMP vs LTP

CMP stands for Current market price, whereas LTP stands for Last traded price. Though these two terms are often guessed as similar, they have different meanings.

While we learned about what is CMP, LTP is the last price at which a particular stock was bought or sold. When trading volume is high the LTP might affect the CMP because it was the last actual traded price.

CMP and LTP are never constant but they change differently. While CMP changes due to volatile market conditions, LTP changes with every trade made. With each transaction of that particular share by any trader, the last traded price changes. To understand better, we have published a blog dedicated to LTP. Click here

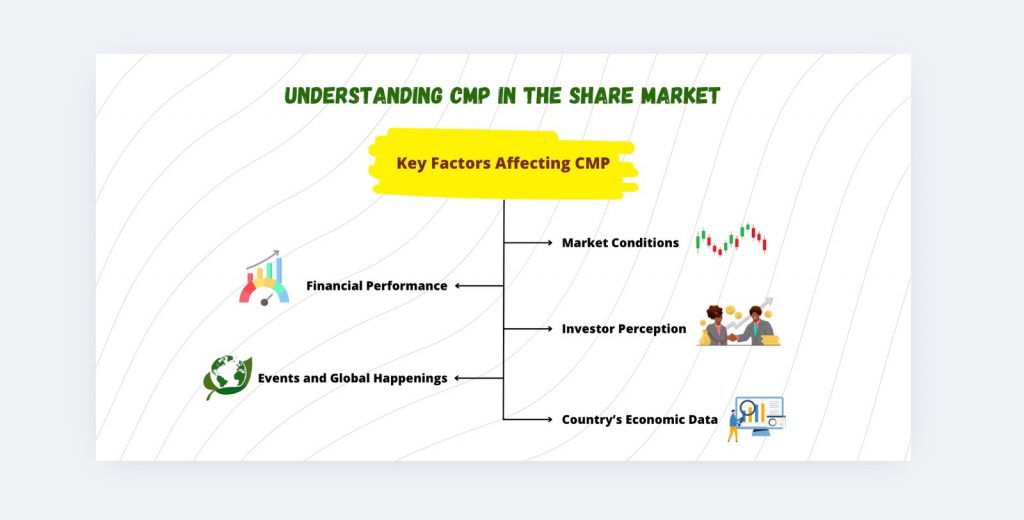

Key factors affecting CMP

Various factors affect the current market price in the share market. Some of these are,

- Market Conditions

The company’s CMP is highly impacted by the substantial changes taking place in the market. A bullish market might take up a pace for the share price whereas a bearish market can lead to a reduction in the current market price of the share. - Financial Performance

The company’s financial performance plays an important role in the CMP of its stocks. Its sales, profit margins, dividends, and profitability impact the demand for the share in the market. - Investors POV

The better the goodwill of the company, the more the investors are interested. Investors’ point of view on whether to invest in that particular share or company makes a huge difference in the CMP of different company’s shares. - Events and happenings

Not only the events taking place inside the company but events at the global level also impact the CMP of the stock. Pandemics, Political scenarios, natural happenings, inflation, and market conditions impact the company and its industry to another level. - Country’s economic data

GDP, inflation, recession, and unemployment rate are some of the economic indicators which impact the company’s CMP. The better the economy, the more the demand.

Where is CMP used in trading?

The current market price is used in the stock market in market orders, limit orders, and stop-loss orders.

- Market order

Market order means the order where trade is made at the current price prevailing at the market. The trade takes place immediately and at the current market price of the stock. - Limit order

When the trader sets the limit to buy or sell the share at a specific price, it is called a limit order. A limit order is only applicable for the particular day the order is made and cancels out at the end of the day if not executed. - Stop loss order

The trader set a price to limit their losses in case of sudden downhill of the stock price. It helps the trader prevent big losses in case the market falls. The stop-loss price is lower than the CMP in the case of a sale order and higher in the case of a buy order.

Conclusion

CMP broadly known as Current market price signifies the price of stock at the current time. It helps the investor to make investment and trading decisions. CMP changes constantly and can be looked up at the trading platforms. Do not confuse LTP with CMP as there’s a huge difference between the two.

FAQs

- What is CMP?

CMP is the current market price of a particular share of the company at a particular time at which the investor or trader can buy or sell the share. - What makes CMP move?

Numerous factors affect CMP’s move, including the company’s performance, the country’s economy, market conditions, demand for the stock, etc. - Is CMP important to make investment decisions?

CMP helps the investor to make investment decisions as it helps the investor to understand how well the stock could perform in the future. - Are LTP and CMP the same?

No, LTP and CMP are not the same. CMP is the price at which the stock is currently available to trade whereas LTP is the price at which the stock was last traded.