Financial Modelling

Financial modelling is a skill in Financial analysis that combines accounting, finance, and business metrics to create a forecast for a company’s future performance.

It is an approach used by almost every business, investor, and individual to make financial decisions. Financial modelling tools are the tools used to create financial forecasts for the assessment of the future financial performance of the company.

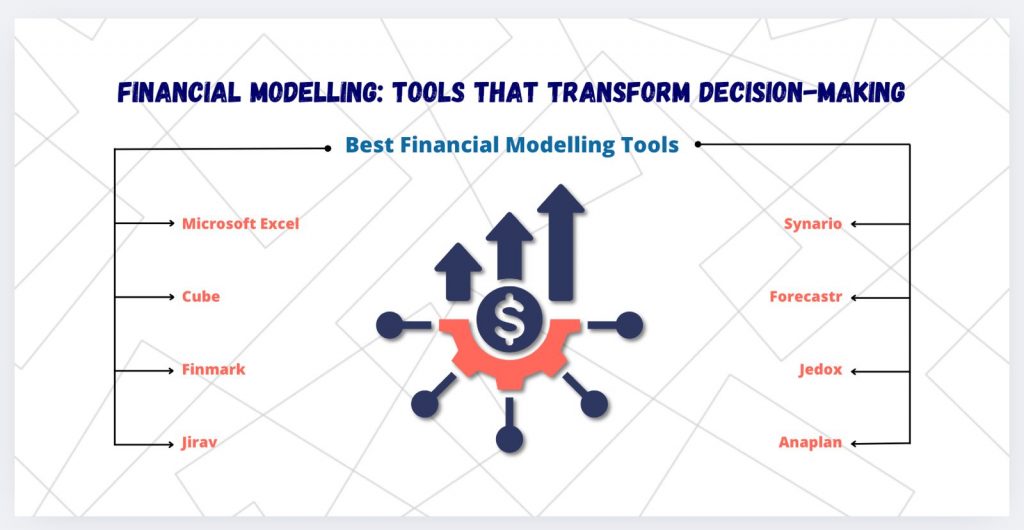

Best Financial Modelling Tools

1. Microsoft Excel

The go-to finance tool for financial modelling is Excel. This is because of the ease of use of the application with grid format and the availability of a variety of formulas.

Excel is user-friendly as it allows its users to play with pivot tables, calculations, charts and much more. Data entry, number crunching, and graphs are a few of its popular uses.

2. Cube

With an impressive user-friendly interface, this financial modelling software is handy for forecasting beyond basic projections. It shows real-time performances, automates repetitive work, reduces errors, speeds up collaboration, and helps the user make better financial decisions.

Cube works with Microsoft Excel and Google Sheets and is available on both Macs and PCs. Some of its key features are automated data consolidation, user-based controls, multi-currency support, annual budget, monthly or quarterly forecasts, sales forecast, Opex planning, break-even analysis, etc.

3. Finmark

Another user-friendly and simple software for financial modelling is Finmark. It helps the business to plan growth by building accurate models and simplifies money planning.

It is best suitable for startups and small businesses as it easily creates, manages, and updates financial models. Some of its key features are model customisation with multiple situations, providing visualization options, team collaboration on finances etc. However, it primarily focuses on SaaS companies and offers limited integrations.

4. Jirav

Offering a driver-based budgeting model to its users, Jirav is one of the best financial modelling tools available in the market. It is faster, more collaborative, and more comprehensive user-friendly software.

It helps the user to combine accounting, financial planning, forecasting, analysis, real-time feedback, and reporting. The software offers financial forecasting, and cash flow projections, provides workforce planning with data modelling, and includes executive summary reports.

5. Synario

This financial modelling application comes with a pre-mapped accounting feature and integrated financial statements. You can manage multiple accounts and generate income and balance sheets with a general ledger.

The best part of the application is that it provides adaptable and scalable financial models and comes in a cloud-based format without the need to install the app.

6. Forecastr

Another great application for financial modelling is forecastr. It helps the user build a customer financial model from previously available data and comes with the support of a team of financial experts.

The software also offers a real-time dashboard, assumptions tab, automated projections, fractional CFO services and financial analyst support.

7. Jedox

A comprehensive tool for big organisations who are willing to manage their financial planning and analyse their finances better. This app provides pre-configured practice models tailoring specific requirements, allowing collaborations, and data sources, and providing a unified source of information to all financial needs.

The application comes with predefined models to start quick modelling and is beginner-friendly. It integrates data from multiple sources and facilitates cross-departmental collaboration.

8. Anaplan

Anaplan is a software which allows companies to connect, model, and analyse their businesses. It is designed especially for finance teams and businessmen to build their financial models for better finance, sales, and supply chain plans.

It is designed to adapt quickly which helps the finance team to respond to changes in a better way actively. This software also ensures data accuracy, integrity, and accessibility with data management tools.

9. Mosaic

This application helps the user forecast the company’s future financial performance by offering real-time insights, prebuilt templates, advanced assumptions, planning, and predictive data.

It is one of the best financial modelling tools available in the market specially designed for high-growth companies assuring quick performance, forecasting, and analysis which helps the business with quick decision-making.

10. Sage Intacct

A popular financial modelling tool which easily integrates with other systems for accounting, billing, orders and much more is Sage Intacct. This software ensures an enhanced user-friendly interface and offers substantial reporting customisation.

This software imports financial data for seamless integration, creates business plans and forecasts transforms data into insights, and generates historical and forward-looking financial reports.

Conclusion

Financial modelling is an approach used by every business, investor, and individual to make apt financial decisions. There are numerous financial modelling tools available in the market, making it easier to analyse and forecast the future financial performance of the company. Different tools work differently and have their key features. A user can choose the software as per their need and job.