Financial modelling is a vital tool to analyse your finances. It helps to create a summary of the company’s income and expenses in the form of a spreadsheet. It is an approach that allows the business to assess various financial situations, create strategic financial plans, and take informed decisions.

Building effective financial models is essential for budgeting, forecasting, valuation, and assessing the financial performance of the company. It helps investors, executives, and analysts to understand the risks and returns before they take their financial decisions.

These models help the investors, analysts, or the company build the financial plans. It provides a quantitive analysis of the company’s financial performance and future projections. It helps in strategic planning, budgeting, performance monitoring, and ensuring solid decisions

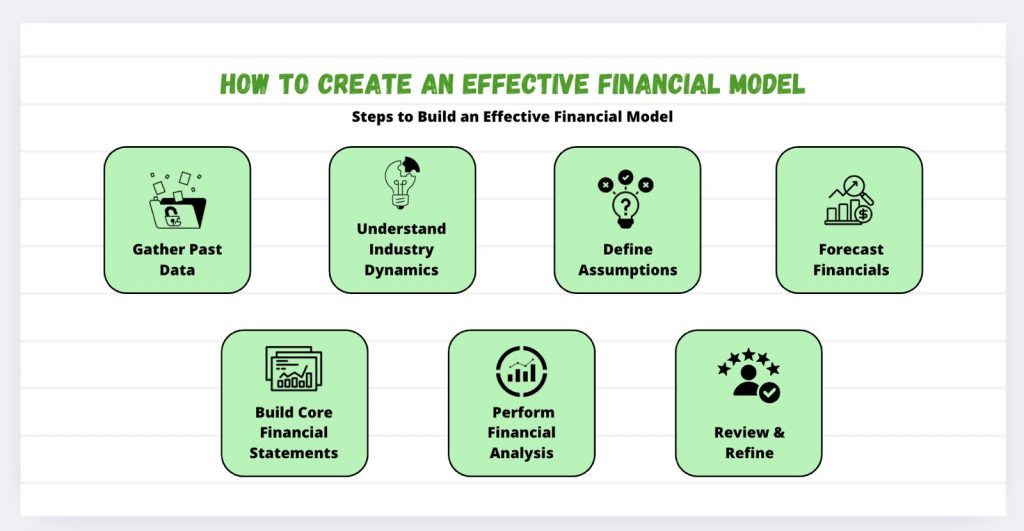

Steps to create effective financial models

1. Gather relevant past data

It’s important to look for the up-to-date past financial data of at least 3 years. You can gather historical financial data, current data, industry trends, market research, workings, and necessary information.

Understand the basics of the company, including the company’s management through its annual report, company’s website, public sources, etc.

2. Understand the dynamics

Understanding the industry dynamics is the next crucial step to build a financial model. It can be done through industry analysis reports. Ensure that you are looking for the right industry to understand the dynamics.

3. Find the assumptions

Assumptions are the evaluations that you make about the future based on the collected data. Make realistic assumptions with the help of historical data, metrics, ratios, etc to calculate future growth margins, rates, turnovers, cost structures, pricing strategies, and projected future performance.

4. Forecasting

Use all the available data and reports to forecast the financial statements. You will need to use your assumptions (made in the last step) to build forecasted statements.

5. Build the financial statements

The next crucial step is to build and create financial statements, including profit & loss statements, balance sheets, and cash flow statements.

The income statement (profit and loss statement) will show the company’s revenue and expenses over a specific period. It’s important as it will help to evaluate the company’s profitability.

The balance sheet will show the company’s assets, liabilities, and equity over a specific period, which will help to understand the company’s financial position and solvency.

The inflow and outflow of the cash will be available with the cash flow statement and if will help to evaluate the company’s liquidity and solvency.

6. Perform analysis

Perform DCF analysis, sensitivity analysis, ratio analysis and scenario modelling by varying assumptions to evaluate models sensitivity and potential impacts on financial results.

Sensitivity analysis will help to test the effects of changing assumptions of the company’s financial performance. By changing a few assumptions you can understand how sensitive the financial model is and determine the further course of action.

DCF analysis will help to calculate the cost of equity through its Capital assets pricing model (CAPM) using rate of return, risk free rate, and beta.

Ratio analysis is the last step, as it is required to calculate profitability, solvency, and liquidity ratios to take better and informed financial decisions.

Once the baseline is ready, you can create multiple scenarios to test the model and analyse the key drivers for better results.

7. Review

Once you have completed all the previous steps, the last step is to use your drafted statement to decide how different scenarios will work. Refine the financial model if needed. The assumptions can be adjusted as the new data becomes available. Test the model against the actual results while refining the model to determine its accuracy and make any necessary adjustments.

You will also need to do final touchups such as minor formations, preparing the index, inserting statements and schedules into the table, etc. It will help the financial model look professional and easy to use.

Conclusion

Financial models are a crucial part of the analysis of financial performance. It is evolving due to advanced technologies and changing business trends. Future financial models can be built comparatively easily with the help of AI algorithms. However even though an expert to analyse the details will be required.