Are you bored of earning a fixed coupon rate on plain vanilla bonds? Do you seek to break this monotony by investing in debt instruments offering a fixed interest rate component and the potential for additional returns? If yes, then you must invest in market-linked debentures (MLDs).

In this blog post, we will talk about market-linked debentures, different types of MLDs in India, and, the list of market-linked debentures in India.

But before we discuss MLDs, check out the FinnovationZ Broker Comparison tool and find a suitable broker to help you invest in MLDs in India.

Market-Linked Debentures Meaning

A Market-Linked Debenture (MLD) is a structured debt instrument that offers returns based on an underlying index or security’s performance. The coupon rate on MLDs is linked to the performance of an underlying index or security.

In simple words, the returns in the form of coupon rates that you generate from MLDs depend on the performance of another instrument. If the MLD’s underlying instrument performs well, you get higher returns. On the contrary, if the performance of the underlying instrument experiences a downtrend, the returns on the MLD Debenture drop.

Further, it is up to the issuer of MLDs to determine the type of underlying it wants to link the MLDs. According to a report on MLDs by CARE Rating, the number of issuances with underlying G-sec has continued to grow during Q1 of FY 2020. Further, Nifty has been the preferred underlying reference index for 63% of the issuances in Q1 of FY20.

It’s important to note that whether the underlying index or instrument performs until maturity, MLDs typically offer positive returns at redemption. That’s because:

- The returns on MLDs are based on the performance of the underlying instrument or index and

- MLDs guarantee to pay back the principal amount even if the performance of the underlying instrument or index experienced a downtrend.

| Performance of the Underlying Instrument/Index | Amount You Get On Redemption |

| Upside | Principal + Coupon |

| Downside | Principal |

Thus, MLDs are safer investment options than direct investments in indexes.

Furthermore, an issuer can issue MLDs through public offering and private placement. However, the most preferred method of issuing the MLDs is private placement.

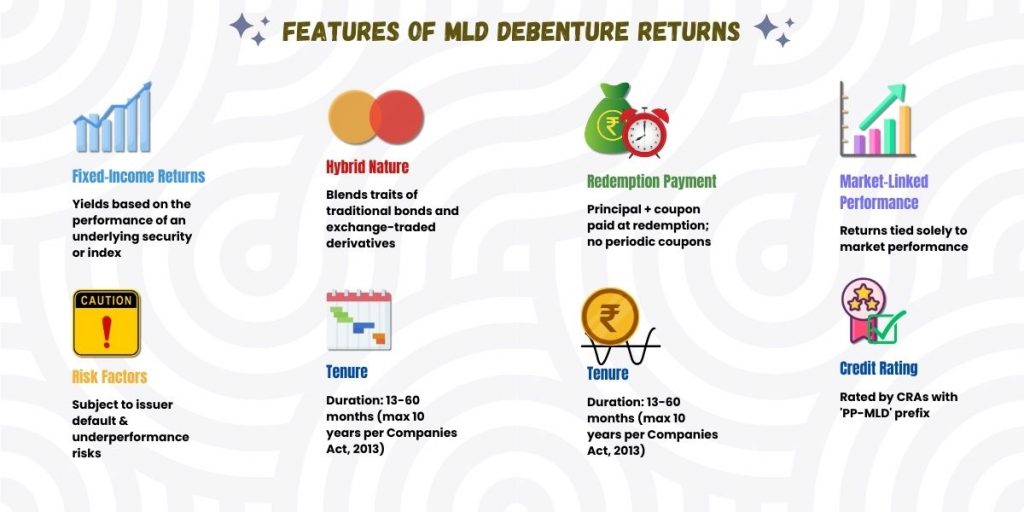

Features Of MLD Debenture Returns

An MLD:

- Is a fixed-income instrument that offers returns based on the return of the underlying security instrument or index

- Offers features of both traditional fixed-income instruments and exchange-traded derivatives

- Pays the principal and coupon amount to the investors at the time of redemption instead of making regular and fixed coupon payments

- Offers returns on redemption based on the performance of the underlying index or instrument

- Has an underlying that is linked to the market and not based on any conditions not related to the market

- Involves the risk of default by the issuer and the risk of the underlying underperforming, giving no returns to the investors

- Has a tenure that ranges between 13 to 60 months depending upon issuer funding requirement, though the maximum tenure for which a debenture may be issued is 10 years as per section 71 of the Companies Act, 2013

- Has a minimum ticket size of Rs 10 lakh for subscription or allotments to investors

- Bears a credit rating by any registered Credit Rating Agency with the prefix ‘PP-MLD’ followed by the standardized rating symbols for long/short-term as specified by SEBI

Types Of MLDs In India

There are two types of Market-Linked Debentures: Principal Protected Market-Linked Debentures (PP-MLDs) and Non-Principal Protected Market-Linked Debentures (PP-MLDs)

Principal Protected Market-Linked Debentures (PP-MLDs)

PP-MLDs are a specific type of market-linked debenture that offers investors a level of principal protection. These MLDs guarantee that the investor will receive at least the principal amount invested at maturity, regardless of the performance of the underlying assets or indexes.

Thus, in the case of PP-MLDs, the downside to the principal amount is protected. As an investor, you will enjoy the upward movement in the return on MLDs indefinitely. But you will have downside protection. Thus, whether there is a return on the instrument or not in terms of coupon proceeds, you shall certainly receive the principal amount. In case of downward movement in the return of the underlying instrument or index, you shall break even.

Non-Principal Protected Market-Linked Debentures (NPP-MLDs)

Non-Principal Protected Market-Linked Debentures are a type of market-linked debenture that does not offer the same level of principal protection as PP-MLDs. In contrast to PP-MLDs, where the principal amount is guaranteed to some extent, Non-PP MLDs do not guarantee the return of the principal investment at maturity. Instead, the returns on Non-PP MLDs are entirely linked to the performance of underlying assets, such as stocks, indexes, commodities, or currencies.

This means as an investor, you are at risk of losing even the principal amount in the case of NPP-MLDs.

It’s important to note that SEBI (Issue and Listing of Debt Securities) Regulations, 2008 do not recognize NPP-MLDs. The rules only recognize PP-MLDs. That’s because debentures are always principal protected while equity involves a risk of loss on investment. Accordingly, if the principal or the investment amount of any security is vulnerable to risk, an equity component gets attached to it. But PP-MLDs are pure debt instruments. This is the reason why SEBI recognizes only such MLDs.

Market-Linked Debentures Example

Fin Capital, a Non-Banking Finance Company (NBFC), issues a PP-MLD with a coupon rate of NIFTY 50 index-linked. The return on the PP-MLD will be 40% of the upward movement in Nifty.

Say, at the time of maturity, Nifty has moved upward 30%. Accordingly, the rate of return on MLDs will be 40% of 30% i.e. 12%. However, if the Nifty moves downward, the investor will not earn any return. Though, he or she will receive the principal amount of MLDs.

It’s important to note that the coupon rates on such MLDs are called variable coupon rates. That’s because the coupon rate on such MLDs varies based on the performance of the underlying index.

The variable coupon rate is also called the participation rate. The participation rate of an MLD denotes what portion of the performance of the underlying will be given in the form of investor return. Thus, in the case of MLDs with a variable coupon, the return on MLDs is directly linked to the performance of the underlying index or instrument.

List Of Market-Linked Debentures In India

The following table showcases the list of market-linked debentures, their rating, and the underlying instrument and index to which they are linked.

| S.No. | Bond Name | Rating | Rating Agency | Coupon Rate |

| 1. | NUVAMA WEALTH FINANCE LIMITED SR I5G203A BR NCD 06JL26 FVRS10LAC | PP-MLD AA- | CRISIL RATINGS LIMITED | NIFTY 50 INDEX LINKED |

| 2. | EDELWEISS ASSET RECONSTRUCTION CO. LTD SR-J8G601C BR NCD 13JL26 FVRS1LAC | PP-MLD A+ (CE) | ICRA LIMITED, | NIFTY 10-YEAR G-SEC INDEX LINKED. |

| 3. | MUTHOOT FINANCE LIMITED SR MLD 5A OPT I TR IV BR NCD 23MY25 FVRS10LAC | PP-MLD AA+ | CRISIL RATINGS LIMITED | NIFTY 50 INDEX LINKED |

| 4. | MOTILAL OSWAL HOME FINANCE LIMITED SR M-7/F.Y.20/F.Y.23 BR NCD 29DC22 FVRS10LAC | PP-MLD AAr | CRISIL RATINGS LIMITED | NIFTY LINKED |

| 5. | NCRED FINANCIAL SERVICES LIMITED SR 0010 BR NCD 23JU23 FVRS10LAC | PP-MLD A+ | CRISIL RATINGS LIMITED | NIFTY 50 INDEX LINKED |

| 6. | IIFL WEALTH PRIME LIMITED SR DDC IV BR NCD 10NV22 FVRS1LAC | PP-MLD AA | ICRA LIMITED, | NIFTY 50 INDEX LINKED |

Conclusion

The returns on MLDs are linked to the performance of underlying assets. Thus, as an investor keen to invest in MLDs, you should carefully consider the terms and conditions of the investment, including the underlying assets, the potential returns, the risks involved, and any fees or charges associated with the investment.