Apart from raising money via share capital, companies also raise capital via Debentures. Debentures are written agreements that acknowledge debenture holders’ debt to the company. These are also called ‘Fixed Income Securities’ as debenture holders/investors receive fixed interest at regular intervals with the principal repayment at the end of a specified period. Convertible Debentures are a type of debentures that can be converted into equity shares partly or wholly at the end of a specified period. In this article, we will cover what convertible debentures are, the types of convertible debentures, and reasons why investors should invest in convertible debentures.

What Are Convertible Debentures?

Convertible Debentures are long-term debt instruments that can be converted into equity shares at the expiry of a specific period. These instruments offer a perfect balance between earning stable returns in the form of fixed interest payments and the opportunity for higher returns to investors from the increase in the stock price. The investors get fixed interest payments at specific intervals resulting in stable returns. At the same time, the option for converting debentures into equity shares after a specified interval gives investors equity ownership with the opportunity to leverage the company’s growth potential.

However, companies can issue debentures with the option to convert such debentures into equity stock only if it is approved by a special resolution passed at the company’s general meeting. Also, Indian companies can raise foreign direct investment from Overseas Corporate Bodies and non-residents by issuing fully convertible debentures apart from equity shares and fully convertible preference shares.

Want to know the benefits of investing in debentures as an investor?

Read our detailed article “All About Debentures – From Meaning to Investing”

Types of Convertible Debentures

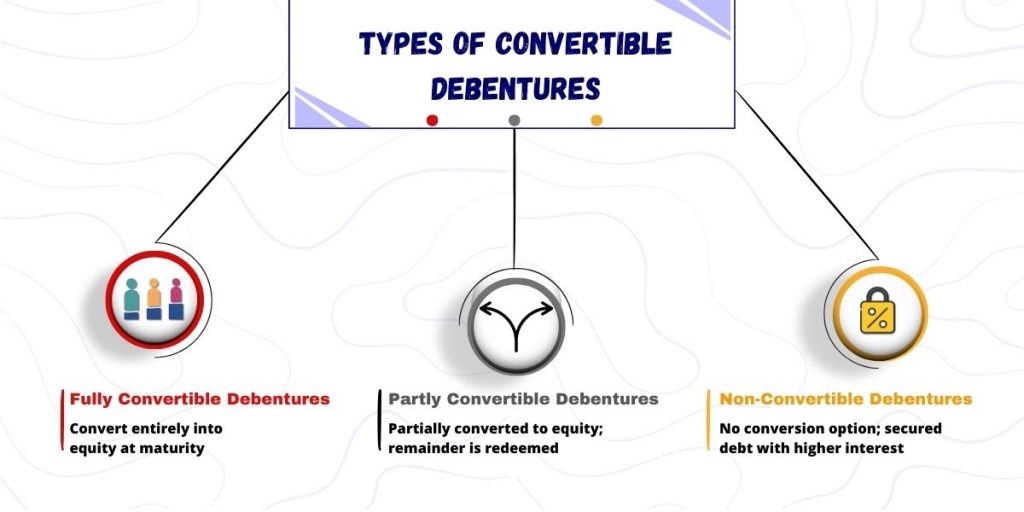

Convertible Debentures can further be of three types: Fully Convertible Debentures, Partly Convertible Debentures, and Non-Convertible Debentures.

1. Fully Convertible Debentures

Fully Convertible Debentures are debentures issued by a company with the option of converting debentures wholly into equity shares at the expiry of a specified period.

2. Partly Convertible Debentures

Partly Convertible Debentures are Debentures issued by a company that has two portions or parts. One part of Debentures can be converted into equity shares at the expiry of a specified period. However, the other portion is non-convertible and is redeemed at the expiry of the specified period as per the terms of the issue.

3. Non-Convertible Debentures

The Non-Convertible Debentures (NCDs) cannot be converted into equity shares at the expiry of a specified period. A company can only issue secured NCDs that create a charge on the assets of the company. In cases where a company issues NCDs that do not create a charge on the company assets, such NCDs must be issued on a recognized stock exchange. Also, since NCDs do not have the option of convertibility into equity shares, the investors are compensated by issuing NCDs at higher coupon or interest rates.

Features Of Convertible Debentures

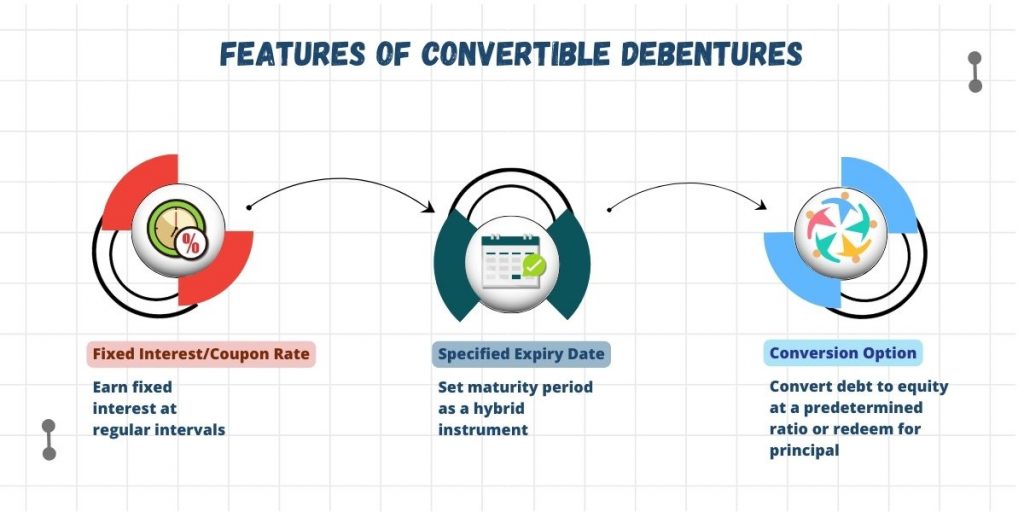

1. Fixed Interest or Coupon Rate

Partly or Fully Convertible Debentures are issued at a fixed interest or coupon rates paid at fixed intervals (typically half-yearly or yearly). Accordingly, convertible debenture holders receive fixed-interest payments enabling them to earn stable returns until maturity.

2. Specified Expiry Date

Convertible debentures have a specific maturity period. These are hybrid financial instruments with longer maturity periods.

3. Option To Convert Debt Into Equity At Predetermined Conversion Ratio

The convertible debenture holders can either hold their securities until maturity or exercise their option to convert debt into equity. In the former case, the convertible debenture holders will get their principal amount back. Whereas, in the latter, the debenture holders convert their debt into equity at a conversion ratio pre-determined at the time securities were issued by the company.

Conversion Ratio Example

Let’s say ABC company wants to expand issued 2% convertible debentures with the option to convert into equity shares at a conversion ratio of 10:1 after 5 years. The company’s stock price is Rs. 50.

Case I

Let’s say the stock price of ABC company increases to Rs. 100 after 5 years. In this case, convertible debenture holders can exercise their right to convert debt into equity and benefit from the company’s stock price appreciation. Thus, investors with a single debenture can convert the same into 10 equity shares worth Rs. 1000 (10 shares x Rs. 100).

In this case, ABC company raises debt at a low interest rate of 5%. However, it also results in equity dilution as the convertible debenture holders exercise their right to convert debt into equity stock to gain from the company’s stock price increase.

Case II

Now, let’s assume that the stock price of ABC company falls to Rs. 30 after 5 years. In this case, convertible debenture holders will not exercise their right, will continue to hold the debt instruments until expiry, and earn fixed interest payments at 5% until maturity.

Why Should Investors Invest In Convertible Debentures?

The following are the benefits attached to investing in Convertible Debentures by the investors.

Potential To Earn Stable Returns With Option To Participate In Equity Appreciation

One of the major advantages of investing in convertible debentures is its hybrid characteristic. In other words, convertible debenture holders earn fixed interest payments at regular intervals, typically half-yearly or yearly. Additionally, they can hold these debentures until expiry and receive back the principal amount from the issuing company. Or they can convert such debentures, wholly or partly, into equity shares at the time of redemption. This way, convertible debenture holders can earn stable returns in the form of fixed-interest payments and benefit from the appreciation in the company’s equity capital.

Option And Not Compulsion To Convert Debt Into Equity

Companies issue convertible debentures with the option to convert such debt instruments into equity. This allows holders of such instruments to convert them into equity shares. However, if the issuing company’s stock prices decline, the convertible debenture holders can continue to hold these debt instruments until expiry, earn interest income, and receive the principal amount. In other words, convertible debenture holders can

Preference Over Equity Shareholders in Case Liquidation

Convertible debenture holders will always get preference over equity shareholders for principal repayment in case the issuing company liquidates. This way, convertible debenture holders are relatively safe compared to common stockholders.

Conclusion

Convertible debentures are hybrid financial instruments that offer investors the benefits of both debt and equity. Investors looking for stable returns with the option to gain from the issuing company’s stock price increase can invest in convertible debentures. They must carefully check the convertible debentures they are investing in, the conversion ratio, and the time period after which such debentures can be converted into equity before investing.