Looking for a career in finance? Wondering if taking up a course can help you out? Then you are at the right place. There are numerous career options in finance and mastering financial modelling can open ways for many of them. The right course can help you pioneer in skills and make better financial decisions.

Benefits of taking up a financial modelling course

Big-time investors and corporations are always looking for finance experts who are well aware of the financial tools and can help them make profitable financial decisions for their businesses. Even though the job can be tough and needs time to learn, it can be beneficial in many careers.

Not only does it open the options for various careers, but also you can gain financial skills. Some of which can be,

- Making informed financial decisions—The first one is obvious: Once you take up financial modelling courses, you can understand finance better and make better, more informed financial decisions. You can evaluate investment opportunities better, compare different options, and also understand the risk and result of your decision.

- By learning financial modelling, you can apply the same skills and techniques for valuation, forecasting, budgeting, strategic planning, and risk analysis.

- You can also gain advanced skills in Microsoft Excel as it is one of the best tools for financial modelling. You can learn to pivot tables and understand complex formulas, and financial functions to build dynamic models.

- Analysing financial statements like balance sheets, income statements, and cash flow statements can become an easy job for you.

- You can master valuation methods such as Comparable company analysis, precedent transactions, and discounted cash flow method.

- You can also master modelling skills like merger and acquisitions modelling, and debt & equity modelling, including synergies, deal structures, debt schedules, and equity financing etc.

- Once you have learnt financial modelling you can create a systematic financial report and pitch it to stakeholders.

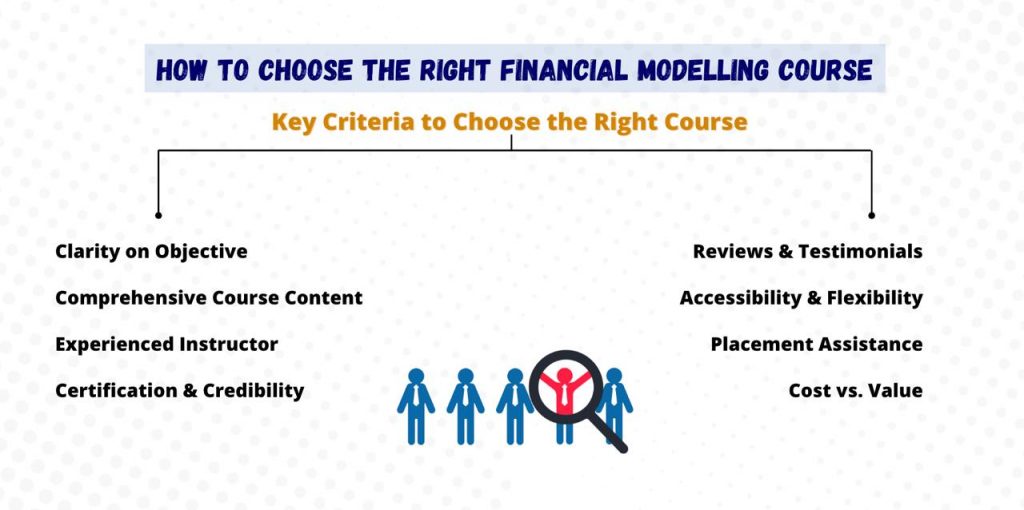

But how do we choose the right course?

There are countless financial modelling courses available in the market and choosing the right one can be difficult. Well if you ask us, there is no perfect or best course to be defined precisely. But you can opt for the course which is the right one for you as per your requirements and needs.

Let’s discuss the criteria for choosing the right financial modelling course,

Clarity on objective

Before you step into taking up the course for financial modelling, you need to understand your objective. Do you want to switch your career or just improve your skills or you are willing to learn financial modelling as an extra skill? Once you decide your objective with a clear mind, you can choose the course which is right for you.

Course content

Looking for courses that cover a wide range of topics and in-depth research and workings can be a great move. The course must cover a variety of subjects, including advanced Excel, forecasting, valuation, budgeting, etc., to better understand financial modelling. It should also be up-to-date with current practices and offer a practical approach to the case studies for better application of the theoretical knowledge.

Instructor

An experienced faculty working or teaching in the industry for a long time can help you understand the financials better. Always opt for a course where the expert has real-world experience, is well qualified, has professional experience or a degree and can help you achieve your goals. Most companies will offer a detailed idea of their faculties for each course.

For example, Mr Prasad R. Lendwe popularly known as Namaskar Prasad who is the founder of FinnovationZ and teaches the financial modelling course has over 10 years of experience in the financial service sector.

Credibility and certification

A reputed institute with credible connections and accreditation is always a better choice as compared to one with a lesser-known one. A certificate from a certified course and company will help you land a better job in the finance industry.

Reviews and testimonials

One of the most important criteria when choosing a course is reviewing and getting feedback from previous students. Look for reviews with both positive and negative comments to better understand the course’s suitability.

Secured placement

Many courses and companies offer placement assistance once the course is completed. These not only help the student to earn employment but also increase their network in the industry.

Accessibility

Nowadays, there are courses available in both offline and online formats. Choose the course that fits your schedule and timings. You can opt for live classes or pre-recorded classes to watch as per your comfort and time.

Cost

Different courses come in different costings. Some may seem expensive but will give you better results while some may seem less costly with limited knowledge and subjects. Give priority to the benefits the course is offering as will develop your skills and help you upgrade your profession.

Bottom line

Choosing the best financial modelling course can be a tough decision but once you choose the right course, there’s no looking back. The right course will help you advance your skills, increase your financial understanding, achieve your financial goals, and advance your career by opening new career opportunities.

If you are interested in taking up a budget-friendly but worthy financial modelling course, you can explore the Financial Modelling and Valuation Mentorship course by FinnovationZ where Namaskar Prasad will teach you right from the basics to an advanced understanding of financial modelling.